A famous saying in the business world is, “If you can count all your assets, you always show a profit.” The Warren Buffets of this world recognize the importance of tracking assets for personal and entrepreneurial finance.

You need an asset list template to keep track of your assets and their values. The template allows you to classify assets based on their positive economic value, liquidity, and state. In this post, we get into what entails an asset list and how to prepare a professional one.

What is an Asset List?

In the simplest form, an asset list is a register of anything valuable a company owns. Assets are resources the business, individual, or government controls and expect positive economic inflow. You usually list the assets based on condition, ownership, location, historical cost, and current valuation in an asset list.

Asset Lists for a business usually go on the balance sheet that lists assets, liabilities, and equities. It is essential to correctly identify your assets as that keeps you afloat in business and enables you to make near-perfect financial projections.

Note: Medium and small-sized businesses use financial management software to keep track of the business’s economic valuation and operation. But when you export the asset list from the software, you have reverted to the initial problem of asset listing, similar to pen and paper listing. Ensure the software you use can integrate modern templates and has room for continuous adjustments.

What is an Asset List Template?

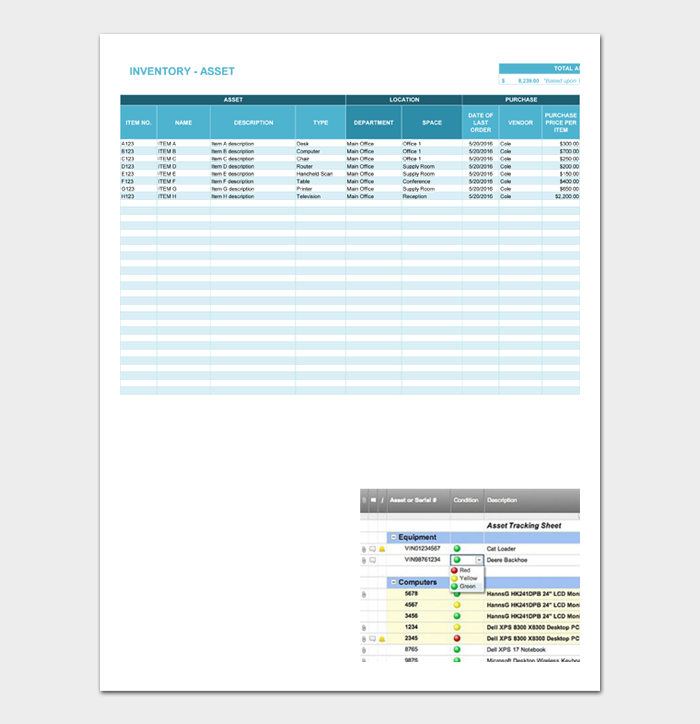

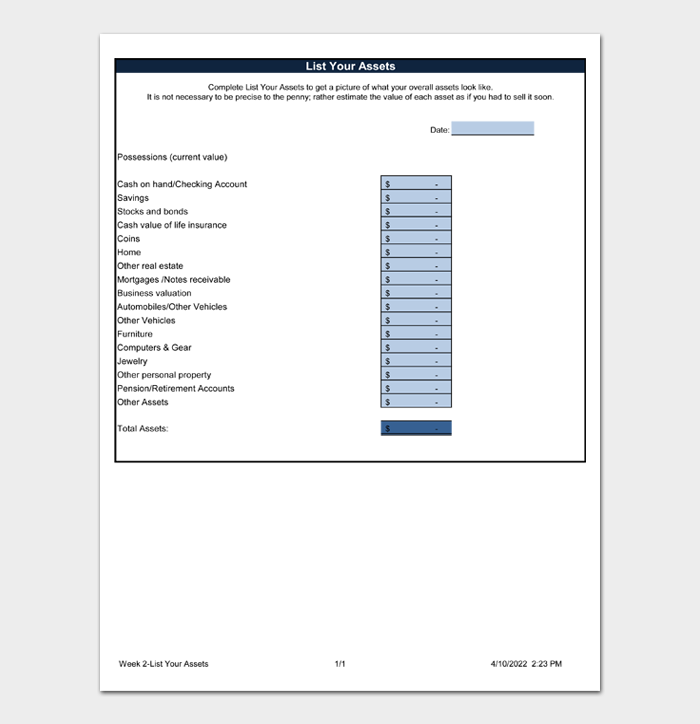

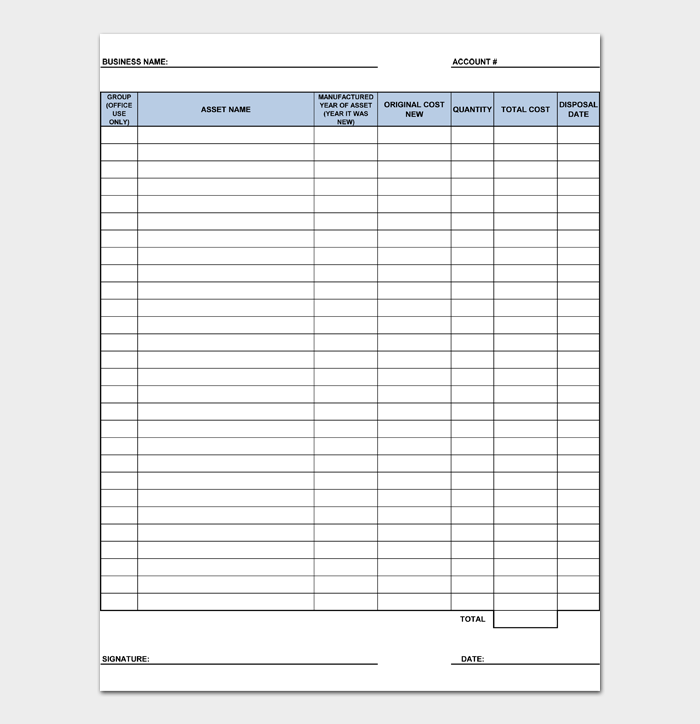

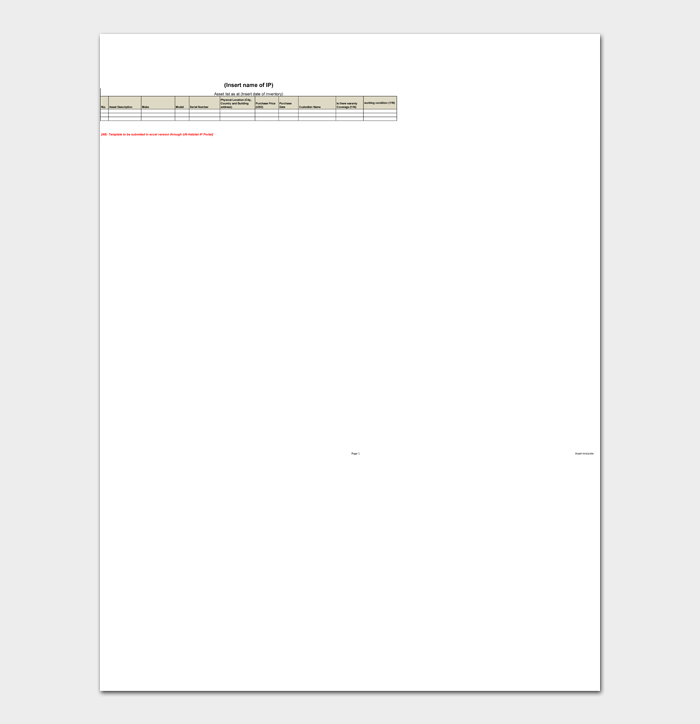

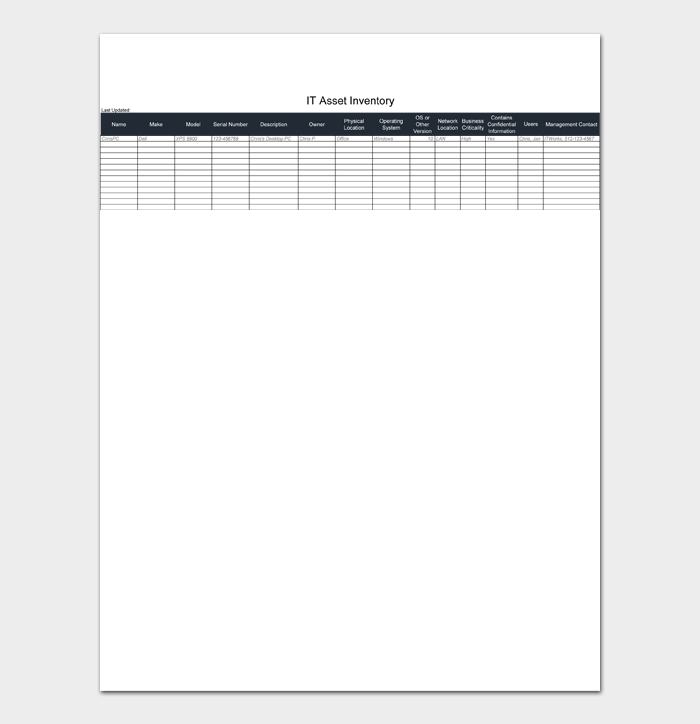

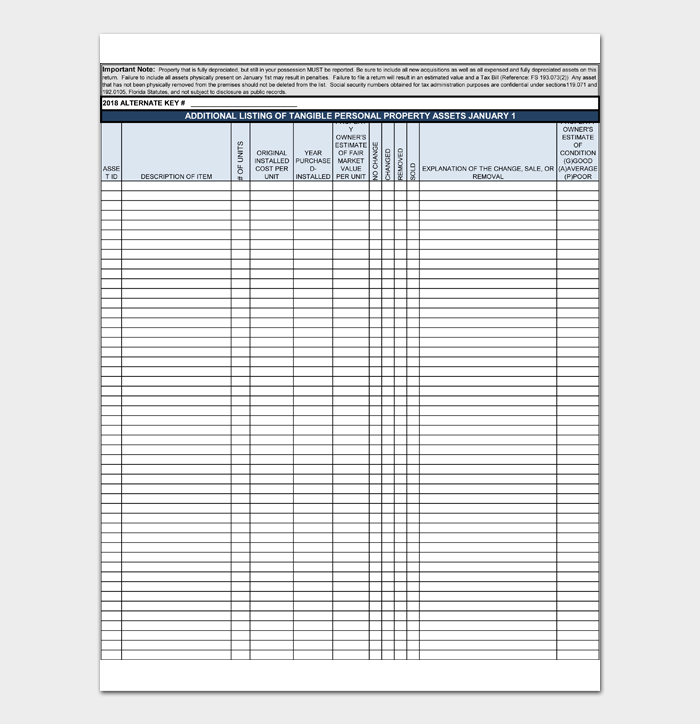

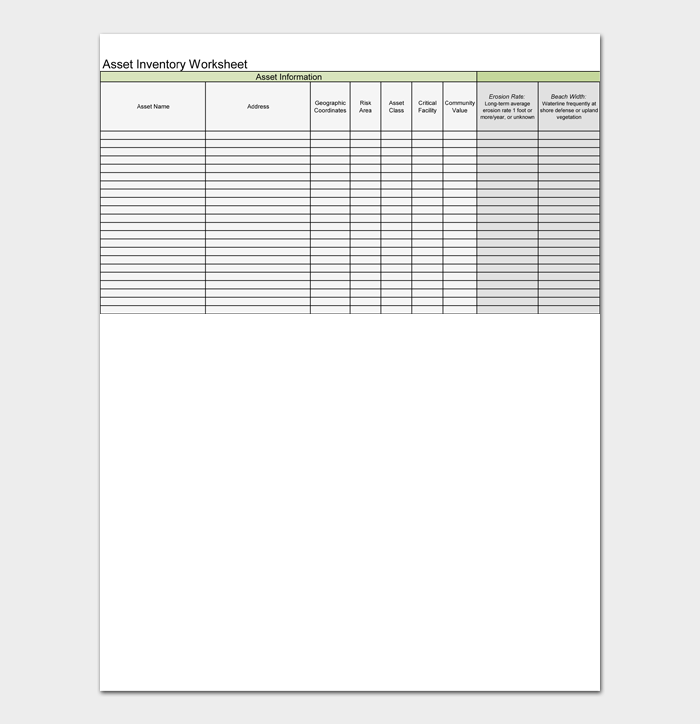

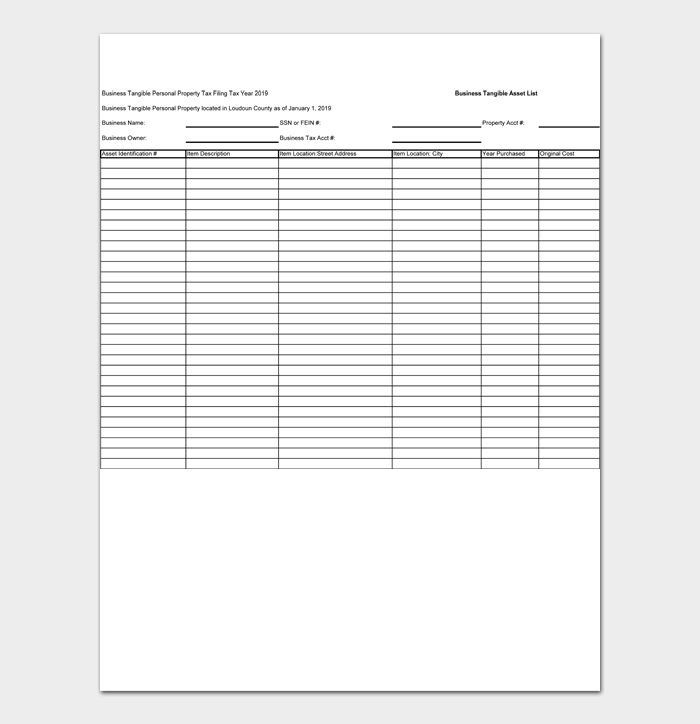

An asset list template is a pre-drafted asset list containing the classification metrics. All you need to do with an asset list template is fill in your assets and classifications according to their enlisted categories.

Asset list templates make asset listing easier, especially for DIY businesses. There are personal and business asset lists. There are subclasses of the lists under the two categories depending on an individual and business’s unique nature. Be sure to obtain a template that suits your needs or is a close fit.

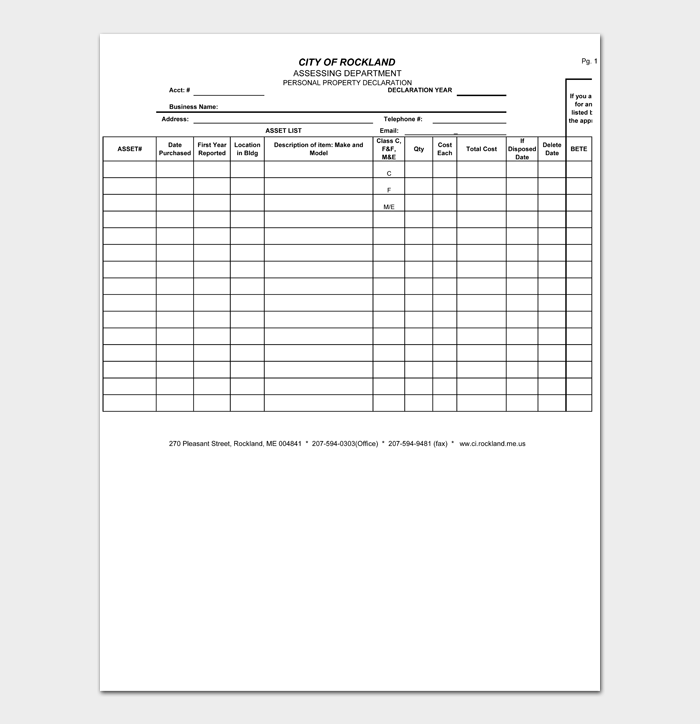

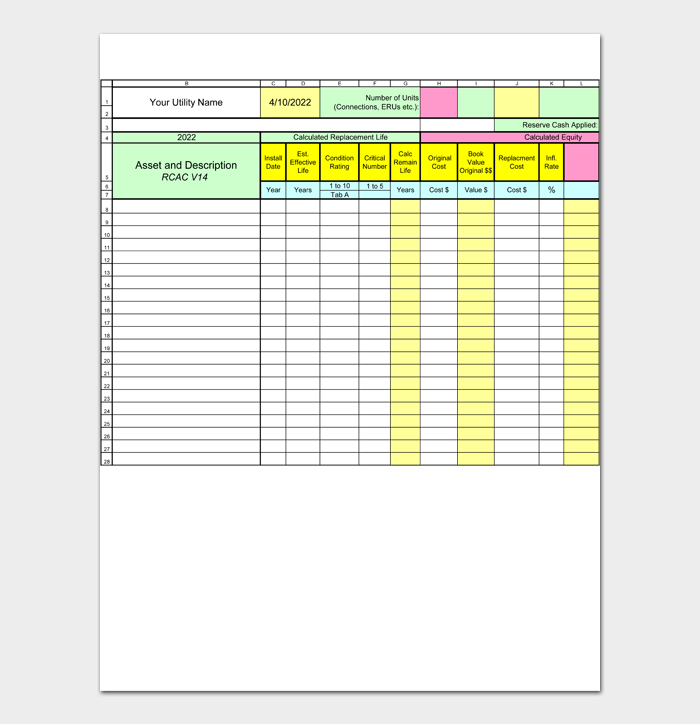

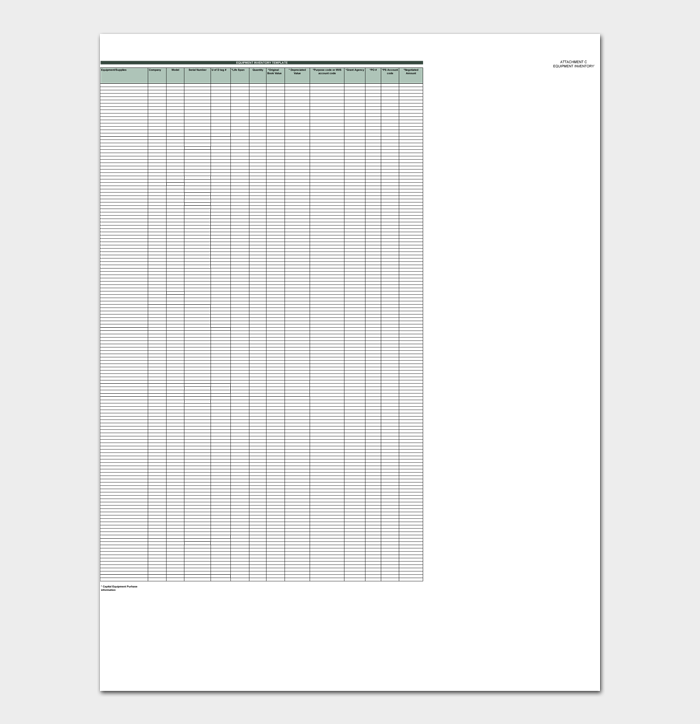

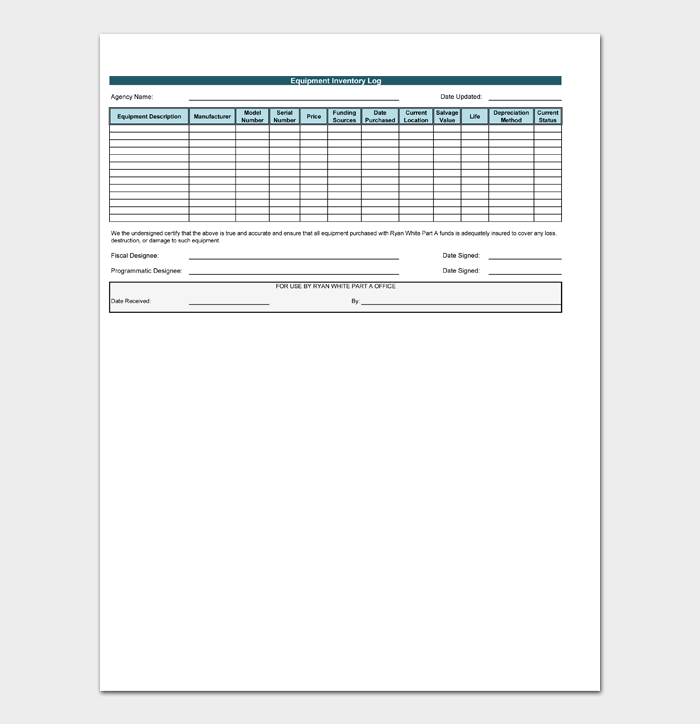

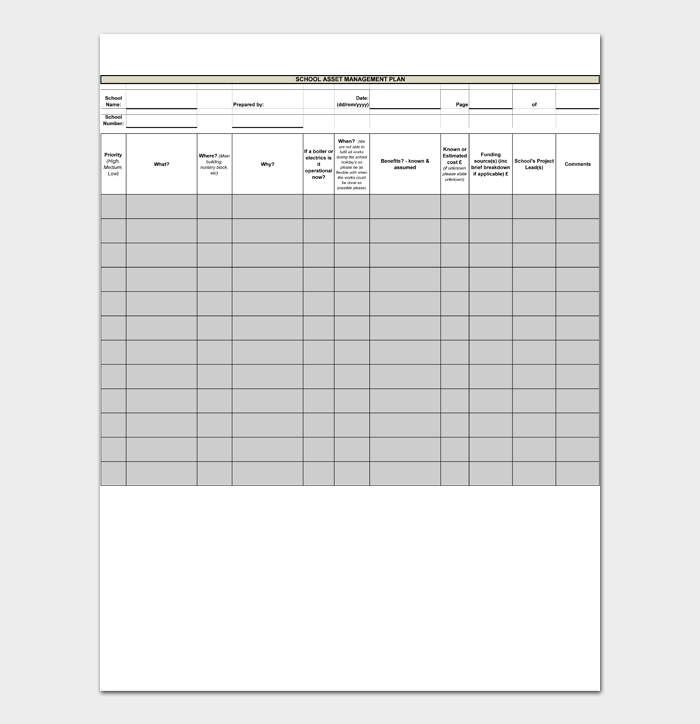

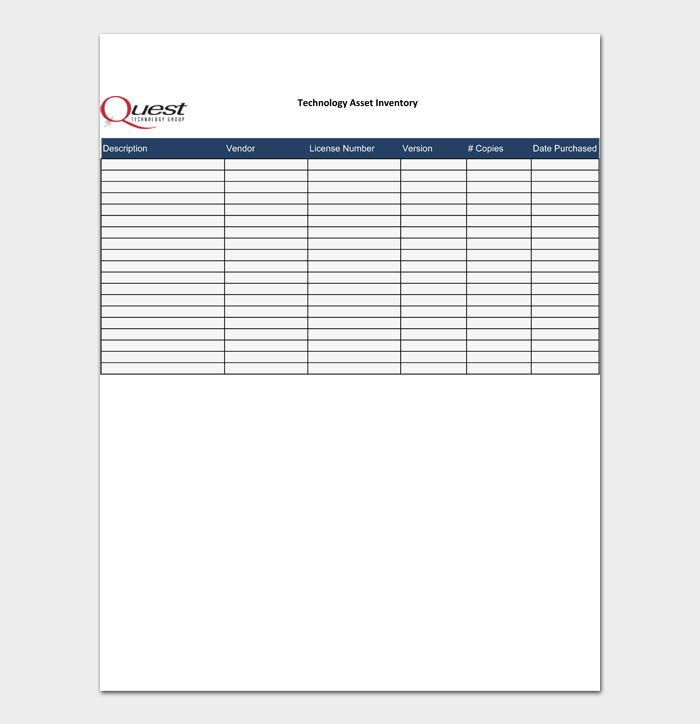

Asset list Templates & Examples

Types of Asset Lists

Asset lists generally follow a capitalization policy. You list assets if they are within a specific value range. For example, a company may set the base value at $2,000. It means they will list only assets from $2,000 and above. Based on that policy, we have asset lists based on liquidity, usage, and physical existence that generates the following:

Current Assets

Current assets are assets that a business can easily convert to cash, usually in under one year. The list of current assets comprises:

- Cash and cash equivalents

- Inventory

- Accounts receivable

- Prepaid expenses

- Short term investments

- Treasury bills

- Work in progress items

- Certificate of deposit

- Market securities

Fixed Assets

Fixed Assets or non-current assets are valuables that a business cannot readily convert to cash or cash equivalents in the short term (1fiscal year). Fixed assets include:

- Land

- Machinery

- Long term investments

- Property, plant, and equipment

Note: Some financial advisors list intellectual property such as logos and brand names under fixed assets which defies the logic that fixed assets must be physical. Intangible assets can be considered fixed assets since they do not directly influence the company’s balance sheet but increase the business’s overall value over time.

Intangible Assets

Intangible assets lack physical existence. In that, they cannot be touched. Some types of intangible assets include:

- Intellectual property

- Logos

- Secret recipes

- Licenses and permits

- Goodwill

- Patents

- Trademark

Non operating Assets

Non-operating assets generate revenue but not on a day-to-day basis. They include:

- Marketable securities

- Short term investments

- Interest from a Treasury bill or fixed deposit

- Vacant land

Operating Assets

Operating assets are required for the day-to-day operations of a business. The assets that generate income daily are:

- Cash

- Accounts receivable

- Inventory

- Machinery

- Equipment

- Goodwill

- Patents

The Asset Classification

Asset classification is generally grouped into three categories:

- Usage that splits into operating and non-operating assets.

- Physical existence subdivides assets into tangible and non-tangible assets.

- Convertibility of the assets that categorizes assets under fixed or non-current and current assets

Making an Asset List

Making an asset list is relatively simple, especially if you have an iota of where the assets are and accompanying documentation.

Tip: Develop a serial number system where you can succinctly describe the assets. Include only the location condition and value. You can then use the serial number to make an asset list instead of cluttering your asset list.

An asset list is vital to gauge your financial health. Here’s how to make a professional asset list:

Step 1) Choose a recording system

The preliminary step is to select a record-keeping system. You can opt for integrative software, MS Word or MS Excel. Excel is easier to use since Word doesn’t have the necessary functions, while software may be hard to use on the first try.

Step 2) Classify your assets

There are many categorizing metrics for classifying assets. You would want to start with splitting into physical and intangible assets. Further, classify them as operating or non-operating (this won’t be necessary if yours is a big business).

Step 3) Describe the items

Remember your serial numbering system? Start with a SIN on the left and enlist the assets in each row. Provide an accompanying description of the assets. You can be descriptive as you wish. Although to keep it professional, describe the following:

- Evidence of ownership

- Location information

- Beneficiaries of the asset

- Personal information such as the company name, owner, and tax information.

Step 4) Finalize your list

Counter-check to ensure you have captured the necessary details. Once done, save the document. You may need to edit it as asset prices and numbers fluctuate as your business grows.

Protecting Your Asset List

An asset list has financial and legal implications when it falls into the wrong hands. To safeguard your asset list, authorize only trustees that can handle affairs of assets. You can name the company lawyer and two managerial cadre members as the trustees. Ensure they sign a legal document that they consent to make it legally binding.

You can also create copies of the asset list. Attach the list to your purchase receipts for the assets to add an extra layer of protection. You can never be too secure. Double up your protection measures with a USB drive and some external drives that contain the asset list information.

Final Thoughts

If you want to start a new business or expand your current one, you need to keep track of your assets. You can prepare your asset list and make better financial decisions by now. Remember, asset lists are not set in stone. The wise entrepreneur always updates their asset list at the end of every fiscal year or after purchasing or liquidating an asset.